During the consolidated fiscal year under review (January 1, 2024, to December 31, 2024), the Japanese economy was on a gradual recovery, albeit with some signs of a standstill. Meanwhile, overseas economies were impacted by monetary tightening, concerns about the uncertainties surrounding the Chinese economy, potential policy shifts following the change of government in the United States, and geopolitical risks arising from the ongoing severe tensions in regions such as Russia and Ukraine, and the Middle East.

In the electronics industry has seen strong investments continuing in advanced areas, particularly with data centers benefiting from growth associated with generative AI. Additionally, there are signs of a gradual recovery in demand within traditional areas starting in the second half of 2024.

In the electronic substrate and component industries, which is our group's related market, our relevant products increased and performed steadily, influenced by the electronics industry.

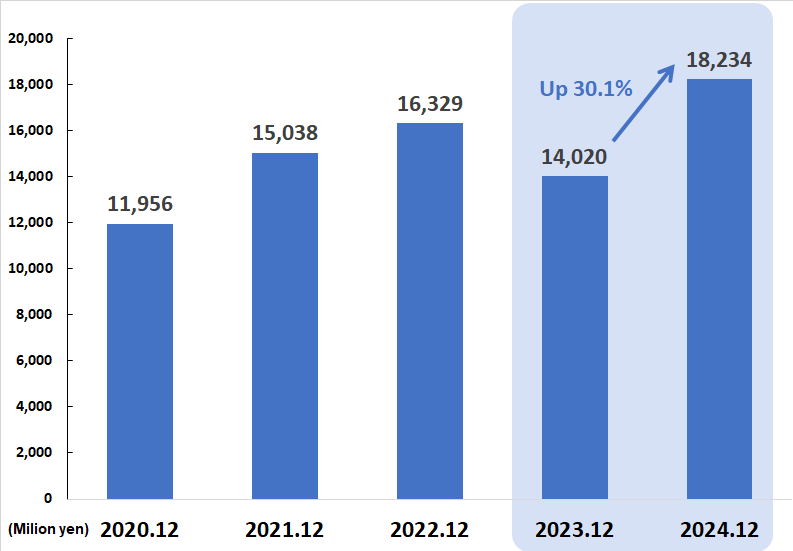

Sales

The Super-Roughening adhesion enhancement, the CZ Series, which have captured a significant portion of the market for package substrates incorporating semiconductors, experienced a notable surge in sales due to factors such as the growing demand for products used in advanced package substrates, such as those associated with generative AI, and the recovery, albeit weak, in demand for products used in general-purpose servers and personal computers.

As a result, net sales for the consolidated fiscal year under review amounted to 18,234 million yen (up 4,214 million yen, or 30.1%, compared to the previous period).

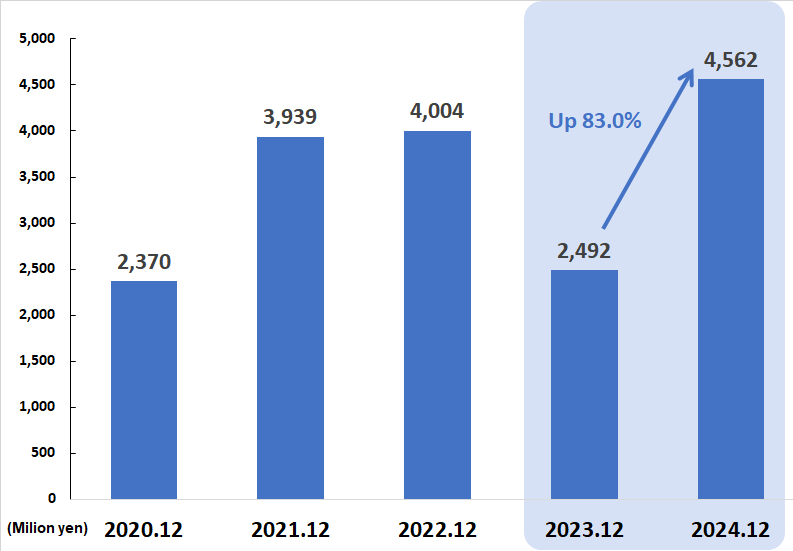

Operating income

On the operating income front, profit has increased significantly due to higher production volumes of chemicals and improved production efficiency, driven by the Company’s global production strategy.

As a result, operating income for the consolidated fiscal year under review amounted to 4,562 million yen (up 2,069 million yen, or 83.0%, compared to the previous period).

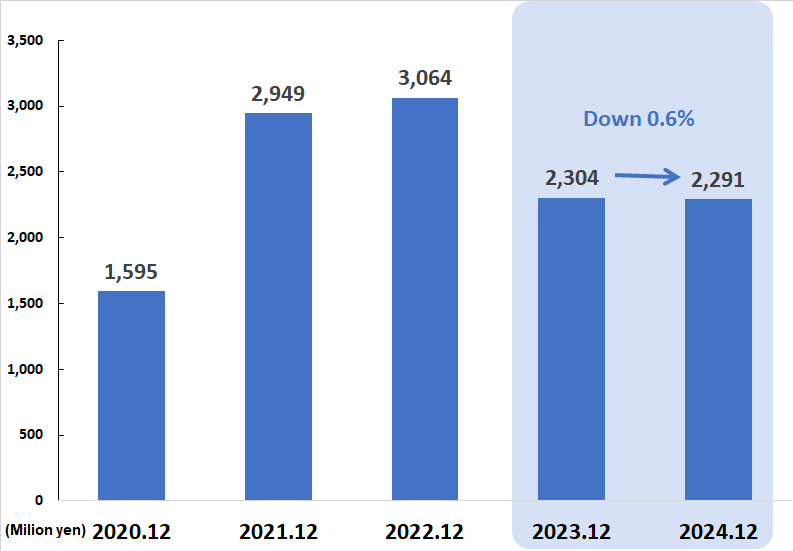

Net income

Net income was taking into consideration business rationality and management efficiency on our way towards the ideal corporate image for 2030, it was decided to dissolve and liquidate MEC (HONG KONG) LTD. whose sales activities are continuously being reduced, and to make its subsidiary MEC FINE CHEMICAL (ZHUHAI) LTD. a wholly owned subsidiary of the Company. Due to the increase in income taxes from recording taxes in Japan and China associated with this group organization, profit attributable to owners of parent decreased.

As a result, net income for the consolidated fiscal year under review amounted to 2,291 million yen (down 13 million yen, or 0.6%, compared to the previous period).